From the May, 2017 PAPER SOURCE JOURNAL:

The good news is that the number of seller-held notes of all types created in 2016 was 62% more than in 2009.

And notes created in 2016 secured by commercial property and land were down just 3% compared to 2015.

The not-so-great news is that the number of newly-created residential seller-held notes dropped 16% in 2016 vs. 2015, according to data compiled by Advanced Seller Data Services (notesellerlist.com).

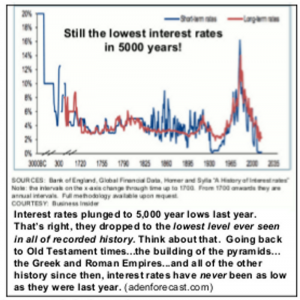

There are at least two reasons for this: 1) The lowest interest rates in recorded history have made home ownership affordable to many more people, so most homeowners have little reason to take back a note in order to sell their house, and 2) the Dodd-Frank Act’s complexity and potential liabilities discourages real estate agents from even suggesting the option of a note to sellers.

Those creating just one note in 2016 made up 81% of the new note market.

The top 5 states: TX (18%); CA (10%); FL (9%); WA (4%) and NC (4%). In last place was SD with just 7 new notes in 2016 (0.0072%).

The news isn’t as bad as it may seem. Although in 2016, 97,089 notes of all types were created, down from 105,871 in 2015 and 116,178 in 2014 (the high point), 2016 was better than 2011 (89,439), better than 2010 (70,159) and especially better than 2009, the first year of tracking data, which had just 60,035 new notes. 2016 is thus 62% ahead of 2009 in new note creation.

My article “Little-Known Cash Flows” in the April, 2017 PAPER SOURCE JOURNAL listed over 50 types of notes other than SFH that you should consider when investing or brokering .