The US Court of Appeals for the Ninth Circuit has ruled that a mortgagee’s security interest cannot be extinguished by the foreclosure of a homeowner’s association “super lien.”

In 2014 the Nevada Supreme Court ruled that a note “super priority lien” held by a homeowners association can extinguish a first deed of trust on a property (see https://papersourceonline.com/5595nevada-notes/ )

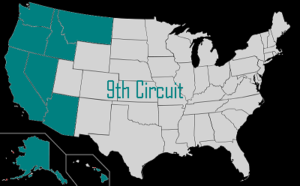

The August 12, 2016 Appeals Court ruling will impact numerous lawsuits in Nevada courts and eight other states (see the map).

BACKGROUND

A group of real estate investors called SFR Investments Pool 1 had foreclosed on such a “super lien” with a balance of $6,000. The investors argued in the case that the foreclosure wiped out a note debt of $885,000 on the property, which was held by U.S. Bank as a first deed of trust.

The Nevada Supreme Court agreed with SFR Investments.

Jonathan Friedrich, a member of the board of the Commission for Common-Interest Communities and Condominium Hotels, called the ruling a potential disaster for the residential real estate business in Southern Nevada.

“If a bank cannot protect its investment, then what bank or lending institution would ever lend money in this state?” he said. “It will hurt home builders and resales and be disastrous to our economy.”

READ MORE:

The Appeals Court decision: http://cdn.ca9.uscourts.gov/datastore/opinions/2016/08/12/15-15233.pdf

Summary of the Appeals Court decision: http://www.ballardspahr.com/alertspublications/legalalerts/2016-08-15-nv-hoa-super-lien-foreclosure-cannot-extinguish-lenders-security-interest.aspx