The Data Says the Market is Shifting—Here’s How Investors Should Be Adjusting

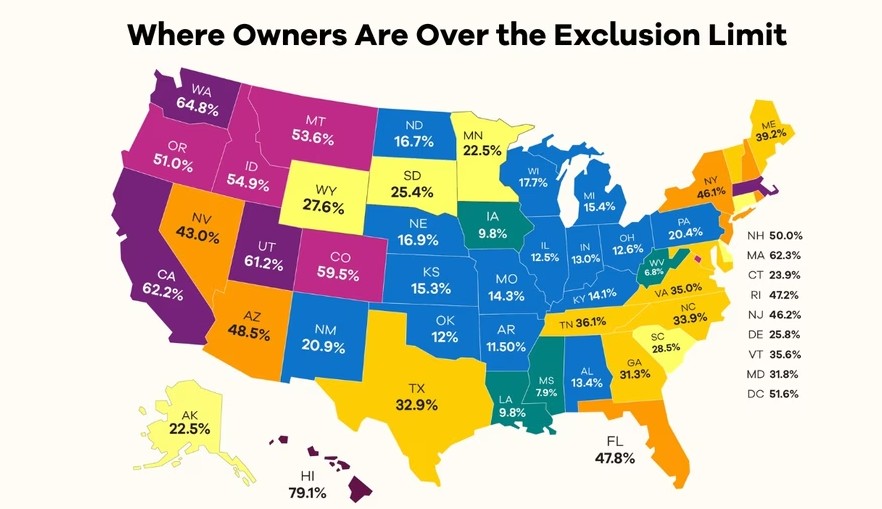

Published by BiggerPockets | July 12, 2025 After years of limited inventory, rising prices, and affordability constraints, the housing market is finally shifting—and that shift is creating opportunities. If you’ve been sitting on the sidelines, waiting for the right time to invest in real estate again, this is your signal: The buyer’s market has arrived. …

The Data Says the Market is Shifting—Here’s How Investors Should Be Adjusting Read More »