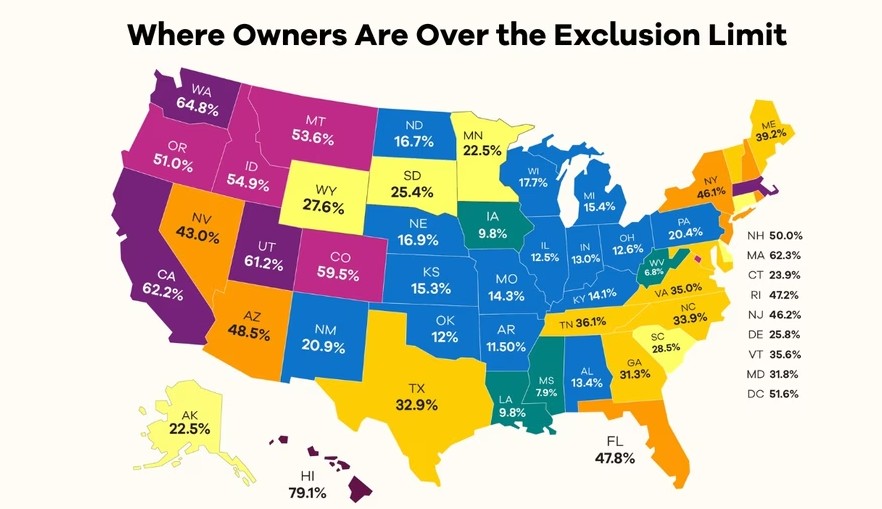

New SALT Cap Could Slash Property Tax Pain for Homeowners in These High-Tax States

Published by REALTOR.com | July 3, 2025 As home values soared over the past decade, property tax bills rose right along with them. For millions of homeowners in high-tax states, property taxes haven’t just been painful—they’ve been punishing. As home values soared over the past decade, property tax bills rose right along with them. But …

New SALT Cap Could Slash Property Tax Pain for Homeowners in These High-Tax States Read More »