We have heard far too many incorrect assumptions from servicers about how various rules will be applied to liens placed by Homeowners Associations (HOA) and Condo Owners Associations (COA) that we feel compelled to set the record straight. The most erroneous assumption is that these rules do not threaten servicers’ lien position, and therefore they are not concerned by what an HOA or COA may do to recover their lost fees.

Let us be crystal clear: unpaid HOA/COA fees are a huge risk not only to the association, but also to mortgage servicers and investors.

Each state determines for its own residents and lenders who serve them the specifics of the powers it grants HOA/COAs and assigns to their liens, in terms of duration, attorney fees, required notices, assessments secured, super lien status, and statutes of limitation. Keep in mind, there are substantial differences from state to state.

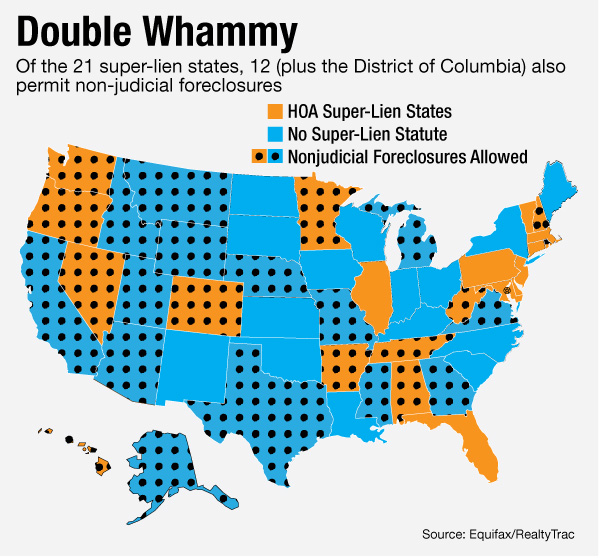

It certainly doesn’t help that there are only eight super lien states that have adopted rules allowing these organizations to place liens that are superior to the mortgage, and another 14 have adopted other laws that give HOAs similar rights under certain circumstances. That means that mandatory community associations in 22 states can file a lien that becomes superior to that held by an investor. And to further complicate the matter, state-level changes regularly take place and new proposals are being considered in state houses across the country.

READ MORE: http://www.dsnews.com/daily-dose/11-16-2016/9-frequently-asked-questions-hoa-super-liens

How do I locate and purchase HOA Super Lien property?

Same question as Tony above.

Ed