Published by REALTOR.com | July 10, 2023

Buying a home today might seem like the most unaffordable it's ever been. However, the baby boomers had it worse.

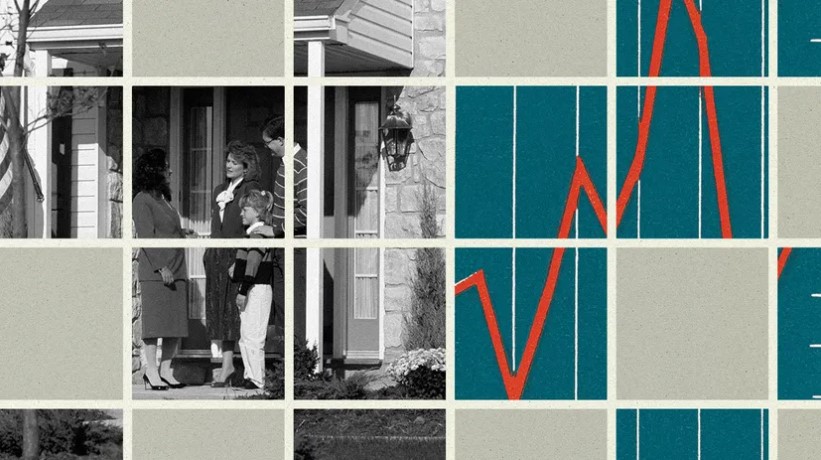

Yes, we’ve all heard it. Buying a home today might seem like the most unaffordable, and therefore impossible, it’s ever been. Home prices are near record levels, pushed up by bidding wars erupting on anything well-situated and move-in ready. Plus, mortgage rates are nearing 7%.

But here’s the thing: The baby boomers had it worse.

In May of this year, the typical buyer spent just under a third of their household income, about 32.8%, on housing. As uncomfortable as that might be, it’s not even close to how much buyers plunked down in the early 1980s.

In 1981, the same year the AIDS virus was identified, the Iran hostage crisis came to an end, and “Raiders of the Lost Ark” topped the box office charts, homebuyers that September and October spent 51.3% of their household income on their mortgage payments.

Let that sink in for a moment.

Furthermore, that percentage doesn’t even include what they paid for utilities, property taxes, insurance costs, and homeowners association fees.

Buying a home is “not as unaffordable as it’s ever been,” says Realtor.com® Chief Economist Danielle Hale. But, “in the grand scheme of things, housing is pretty unaffordable right now.”

To figure out how affordable buying a home has been over the past 50 years, the Realtor.com data team analyzed data going back to 1973. We looked at monthly existing single-family home prices from the National Association of Realtors®, weekly mortgage interest rates for 30-year fixed loans from Freddie Mac, and median annual household income from the U.S. Census Bureau. Then we calculated the typical mortgage payment of a buyer taking out a loan on the median-priced home and what percentage of their household income that would eat up.

The analysis doesn’t factor in regional price differences, new construction, or the percentage of income that individual buyers spent on homes.