Published by Forbes.com | June 23, 2022

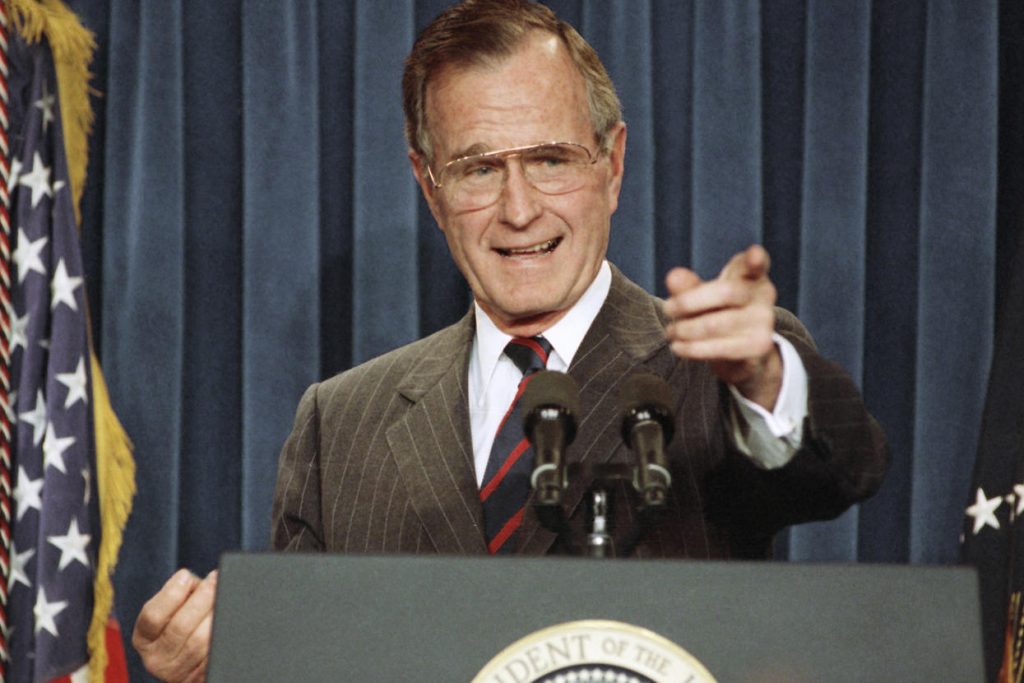

Falling house prices tend to be bad for incumbent politicians during reelections. Take, for example, George H. W. Bush.

Vice President George H. W. Bush was elected president in a landslide in 1988. The U.S. housing market had been booming for years before that election. The Northeast boomed from 1986 to 1988, and California was also booming in 1988. Nationally, nominal house prices increased 14% in the 20 months from January 1987 until the election in November 1988, according to the S&P CoreLogic Case-Shiller Home Price Index.

Eight states voted for George Bush that haven’t voted for another Republican presidential candidate since then. Six of those states were in the Northeast, and one was California. All of those states saw big house price increases in the 1980s.

By 1990, however, house prices nationally had stopped increasing. Real house prices and family home equity wealth fell with the 1990 recession. The number of households losing real home equity wealth was far greater than the number of households losing jobs during the 1990 recession.

From November 1988 to November 1992, inflation-adjusted house prices had fallen 11% nationally, and 24% in metropolitan New York City. From January 1990 to November 1992, real house prices had fallen 22% in metropolitan Los Angeles.

Despite his landslide victory just four years earlier, President Bush lost the 1992 presidential election. A Bill Clinton campaign theme was, “It’s the economy, stupid.” It could have been, “It’s the home equity, stupid.”

If house prices had been more stable and only increased more or less as much as the general inflation rate, what might have happened to George Bush in those two elections?

Would George Bush have still won in 1988? Probably. He won by a landslide anyway, and probably didn’t need a positive push from fast rising house prices to win.

But if house price inflation had been more stable and house prices didn’t fall during his presidency, would George Bush have won in 1992? Maybe.

Since January 2020, real U.S. house prices have increased about 50% faster than they did back during the height of the 1980s boom. Will we see a real estate bust like some cities saw back then?