Published by REALTOR.com | June 24, 2025

Today, roughly 29 million households have built up more home equity than the federal capital gains tax exclusion protects when they sell.

Millions of American homeowners are sitting on a hidden tax burden they never planned for—one that threatens their hard-earned home equity and, at the same time, is tightening the nation’s already strained housing supply.

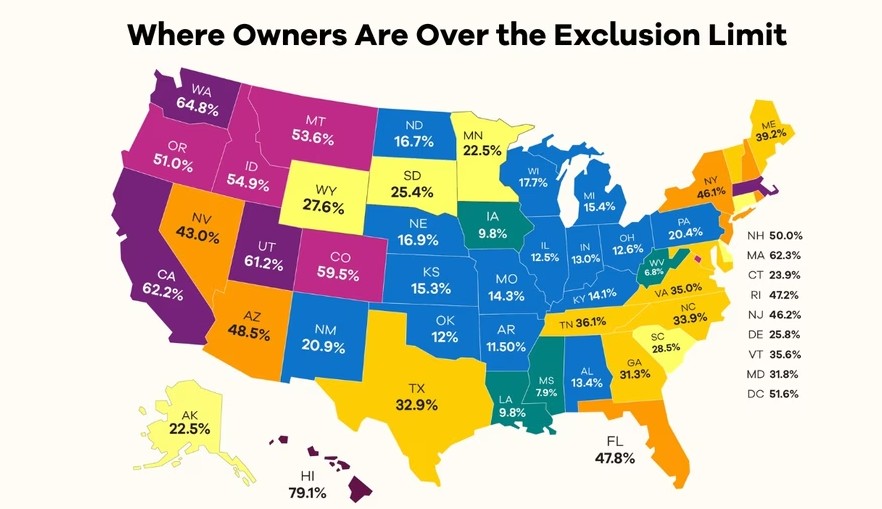

Today, roughly 1 in 3 homeowners—nearly 29 million households—have built up more home equity than the federal capital gains tax exclusion for single filers protects when they sell their primary home, according to a recent analysis by the National Association of Realtors®. By 2030, that number is expected to grow to 56% of homeowners.

Most people don’t think of their home as a taxable investment. It’s their nest egg, future college fund, or inheritance for their kids. But an outdated federal rule, left unchanged since 1997, means the longer you stay and the more your home appreciates, the more likely the IRS will claim a cut when you finally sell.

This home equity tax has big consequences. It erodes family wealth right when people need it most. It discourages older owners from downsizing or moving closer to care. And it keeps larger, family-sized homes off the market, fueling the inventory crunch that’s driving up prices for everyone.

Why the home equity tax exists

The roots of this growing problem stretch to 1997, when Congress rewrote the rules for taxing homeowners’ profits from selling a primary residence. Before then, the process was complicated and frustrating: Sellers could defer paying capital gains taxes if they bought a more expensive home, but they had to keep decades of receipts and faced a tax hit if they ever wanted to downsize.

“It was a compliance mess,” says Evan Liddiard, the NAR’s director of tax policy. “You had to keep track of the first home that you bought and every improvement in every home over the course of a lifetime to show how much gain you ultimately had.”

The 1997 change fixed that headache. It gave homeowners the freedom to exclude up to $250,000 in profit if single, or $500,000 if married and filing jointly, every time they sold a primary home with few strings attached.

The simplicity was key: For most people, the exclusion was so generous that meticulous record-keeping was no longer necessary—and it opened the door to using their home equity to help fund retirement, pay for medical care, or support their kids’ education.

But there was one major oversight: Congress never linked those exclusions to inflation, and now, homeowners are paying the price.

In the decades since, home prices have climbed more than 260%, while the tax exemption has stayed exactly the same. If it had kept pace, the cap would now be about $660,000 for individuals and $1.32 million for couples, according to research from the University of Illinois Chicago.