Published by REALTOR.com | February 1, 2024

The housing market’s outlook remains murky in part because the Federal Reserve’s battle against inflation is not yet over.

Is the housing market bouncing back in 2024—or just bouncing back and forth?

There have been some signs of housing inventory recovering, with the number of homes actively for sale growing by 7.9% year over year in January, according to a recent Realtor.com® report.

That’s “notably higher compared to last year,” according to Realtor.com Chief Economist Danielle Hale.

Mortgage rates have also subsided from their 23-year high of 7.79% in October to 6.69% in the week ending Jan. 26 for a 30-year fixed-rate loan, according to Freddie Mac.

But despite this double dose of promising news, Hale doesn’t expect that America’s housing affordability crisis will improve all that quickly. Rather, she predicts it will take a few baby steps forward, and maybe one or two back.

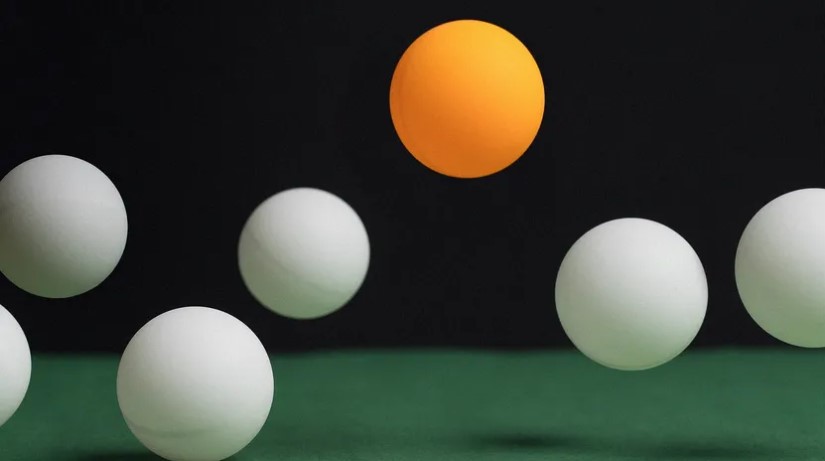

“While gradually falling mortgage rates are helping slow the cost to purchase a home, the housing market will likely bounce back and forth between improvement and status quo over the next several months,” she explains.

It’s also worth noting that housing inventory may be up annually, including an uptick over the past year, but it is still down compared with typical pre-pandemic levels from 2017 to 2019 by a whopping 39.7%.

The housing market’s outlook remains murky in part because the Federal Reserve’s battle against inflation is not yet over. It raised interest rates to bring inflation down.

While the Fed doesn’t set mortgage rates, mortgage rates generally follow the same trajectory as the Fed’s short-term interest rates.

Meanwhile, home prices have remained more or less in limbo, too, inching up 1.4% higher this January than a year earlier, to $409,500.

And even though mortgage rates have fallen from their peak in October, median monthly mortgage payments for January have increased compared with this same month last year. Today, a buyer will pay about $108 more to finance 80% of the typical home than they would have a year earlier.