Published by REALTOR Magazine on August 14, 2020

In June, distressed sales—foreclosures and short sales—comprised just 3% of sales, according to the National Association of REALTORS®

Even as mortgage delinquencies climb, foreclosure activity continues to be low. Foreclosure moratoriums ordered by federal and state governments during early phases of the pandemic likely helped to minimize the foreclosure rate, says Rick Sharga, executive vice president at RealtyTrac, a real estate data firm.

“It’s inevitable that there will be a significant increase in foreclosures once these moratoriums have expired, although it’s unlikely that we’ll see default rates reach the levels we saw during the Great Recession,” Sharga adds.

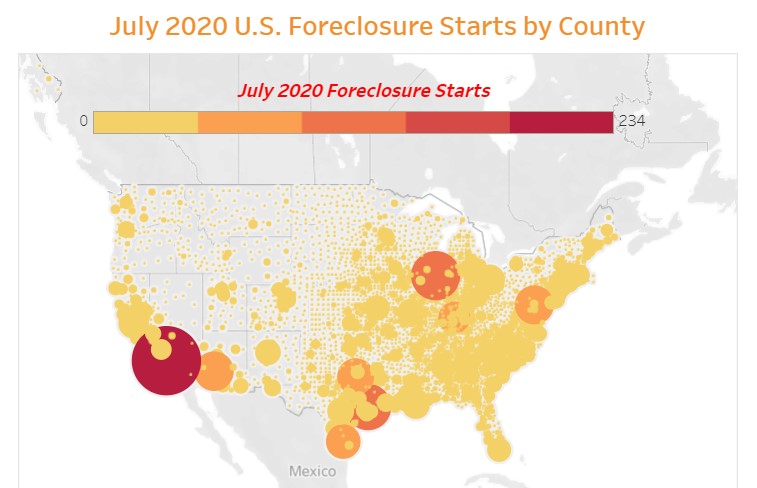

In July, 8,892 properties received a foreclosure filing, which includes default notices, scheduled auctions, or bank repossessions. That is down 83% from a year ago, RealtyTrac and ATTOM Data Solutions report. Nationwide, just one out of every 15,337 housing units had a foreclosure filing in July.

In June, distressed sales—foreclosures and short sales—comprised just 3% of sales, according to the National Association of REALTORS®.

With foreclosure moratoriums still in place, another wave of foreclosures likely won’t materialize until at least next year, after the maximum 12 months of mortgage forbearance expires for homeowners. Economists say if homeowners are able to return to work in that time, the economy won’t need to fear a foreclosure crisis. Still, some impact is inevitable once moratoriums expire, housing analysts note.

“Will there be some fallout? Of course,” Matthew Gardner, chief economist of Windermere Real Estate, told realtor.com® at the end of July. “But I don’t think it will be enough to cause [housing] prices to drop.”