Published by REALTOR.com | May 4, 2024

Since his guilty plea, Cox says he’s reformed and has turned his unusual talents to fighting fraud.

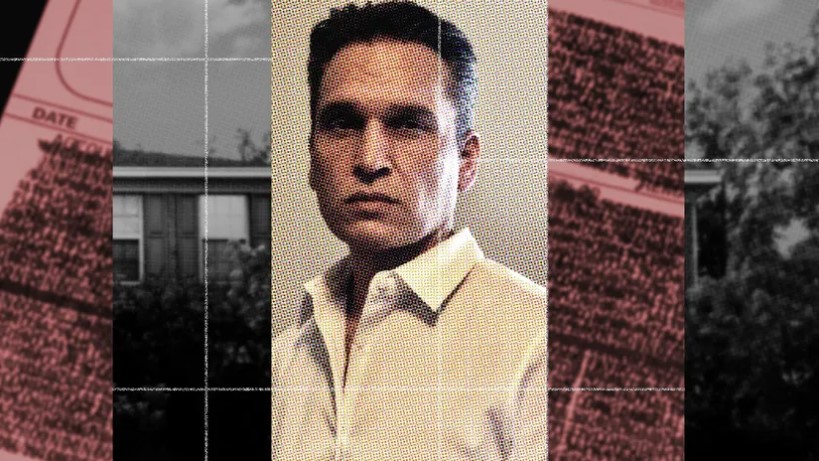

In the late ’90s, Matthew Cox was 29 and starting a new job as a mortgage broker in Tampa, FL, when he committed his first act of mortgage fraud by erasing a borrower’s late payment history from a loan application.

His schemes multiplied quickly. From doctoring loan application information for clients, he went on to mastermind an elaborate series of schemes involving stolen and fabricated identities, phony appraisals, home title theft, and mortgage frauds totaling some $55 million in illicit gains.

After a stint on the Secret Service’s Most Wanted List and the national notoriety of a “Dateline” episode about his crimes, it all came crashing down on Cox with an arrest, guilty plea, and prison sentence in 2007.

While serving time in federal prison, Cox agreed to help the government train mortgage brokers and loan officers to spot potential fraud. Following his release in 2019, he hosts a true-crime podcast, “Inside True Crime.” He also works as a paid spokesman for Home Title Lock, a company that monitors for deed fraud and helps homeowners respond.

In a recent phone interview with Realtor.com®, Cox said he regrets the disruption and expense his crimes generated in the lives of the everyday homeowners who fell victim to his identity theft and forgery schemes.

“That’s something that bothers me,” says Cox, now 54.

In one case, while he was on the run from the FBI, Cox stole the identity of his landlord in the Atlanta suburbs and filed forged documents claiming that the mortgage on the home had been satisfied. Using the landlord’s stolen identity, Cox then took out three new loans against the property totaling $329,000, maxed out credit cards he’d also opened under the stolen identity, and skipped town.

“Let’s face it, if Countrywide Bank lost $2 million … I don’t lose an ounce of sleep,” he says. “But [the Georgia landlord] didn’t do anything to deserve what happened to him. The biggest mistake he made was crossing my path.”

Ultimately, the landlord wasn’t on the hook for the fraudulent loans in his name, Cox says, but straightening out the mess probably caused him “two months of sleepless nights” and significant legal fees.

“I’m sure that the anxiety that he felt was overwhelming, and he’s just one of several people that that happened to,” says Cox of the fallout from his crimes.

From art student to con artist

Cox grew up in Florida and studied sculpture at the University of South Florida, where he graduated with a degree in fine arts.

After bouncing around several entry-level jobs without much success, he landed at a Tampa mortgage brokerage that catered to prospective homebuyers with subprime credit scores.

There, Cox was tasked with preparing loan applications for customers and matching them with a loan for which they qualified. In exchange, he charged a broker’s fee—and sometimes took points on the loan for charging borrowers a higher interest rate than the lowest for which they qualified.

That practice, known as a “yield spread premium,” has since been banned by federal regulation.

Raking in thousands in fees on every successful mortgage deal, Cox turned to fraud almost immediately. To ensure his clients’ loan applications were accepted, he began forging documents such as employment records and bank statements.

Eventually, Cox was creating entirely fictional identities, along with fake companies to employ them and phony banks to generate account statements.

“The fine arts degree helped me create the illusions that I used to further my scams, whether it was the illusion that this person was a real individual, or he had a bank where he had accounts,” recalls Cox. “It helped me create documents, anything to support what I needed in order to get a loan from a bank.”

Cox was first convicted of low-level mortgage fraud in 2002 and sentenced to probation. But after being caught once, his schemes only grew larger and more elaborate.