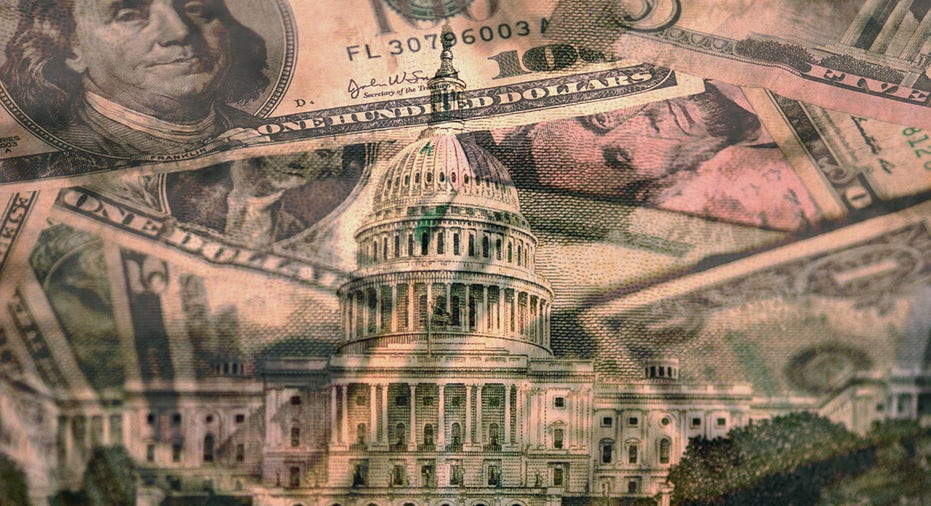

Weak Mortgage Demand Could Get a Big Boost Amid Ukraine Crisis

Published by CNBC | March 2, 2022 While mortgage rates rose to the highest level in two years last week, they have since fallen quite sharply due to the war in Ukraine. Mortgage demand stalled last week, as interest rates hit a multi-year high, but that will likely change quickly. Rates are now falling fast …

Weak Mortgage Demand Could Get a Big Boost Amid Ukraine Crisis Read More »