Published by REALTOR.com | January 20, 2021

Existing-home sales ended 2021 on a high note as home buyers rushed to buy a home to take advantage of ultra-low mortgage rates. Overall, sales were up 8.5% in 2021 compared to 2020, the National Association of REALTORS® recently reported. But the new year could bring about lower sales numbers as more buyers become priced out and find fewer and fewer choices of homes for sale.

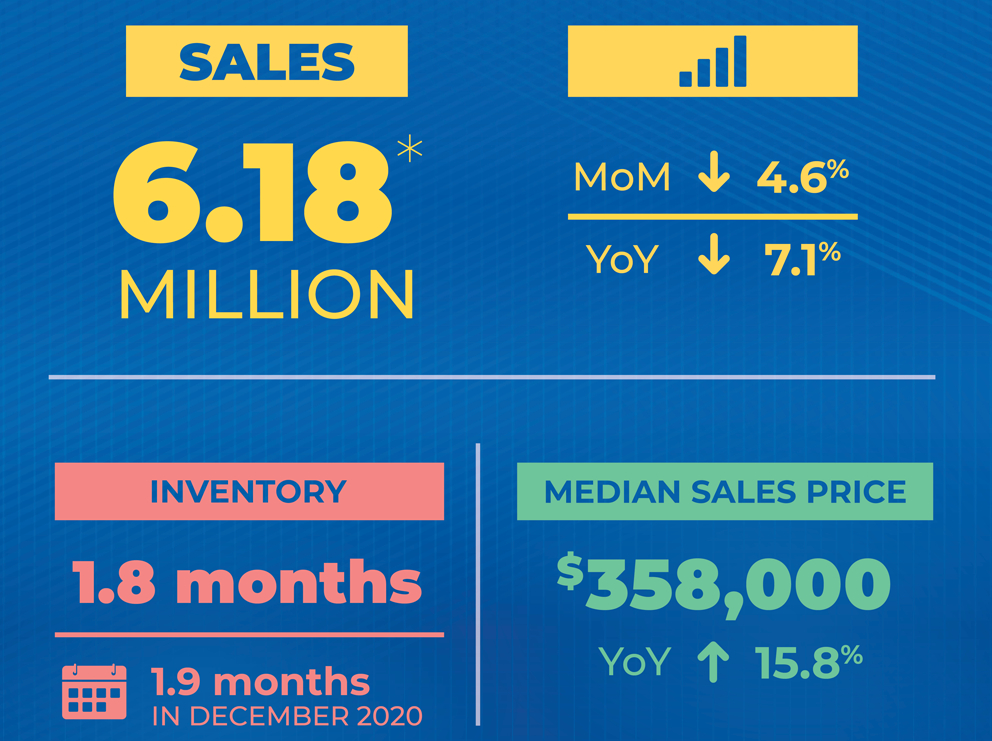

The signs of a slight slowdown are already popping up. In December 2021, while unsold existing homes fell to an all-time low, home sales also dropped. Total existing-home sales—completed transactions that include single-family homes, townhomes, condos, and co-ops—fell 4.6% in December compared to November, NAR reports. Each of the four major regions of the U.S. posted month-over-month and year-over-year declines.

“December saw sales retreat, but the pullback was more a sign of supply constraints than an indication of a weakened demand for housing. Sales for the entire year finished strong, reaching the highest annual level since 2006.”

–Lawrence Yun, NAR’s chief economist.

What Lies Ahead

Yun expects existing-home sales to slow slightly in the coming months as mortgage rates rise. However, he notes that recent employment gains and stricter underwriting standards will protect home sales and that housing is “in no danger of crashing.” Yun forecasts mortgage rates to remain below 4% by the end of 2022 and wages to hold firm.

“This year consumers should prepare to endure some increases in mortgage rates,” Yun says. “I also expect home prices to grow more moderately by 3% to 5% in 2022, and then similarly in 2023 as more supply reaches the market.”