Published by REALTOR.com on October 7, 2o20

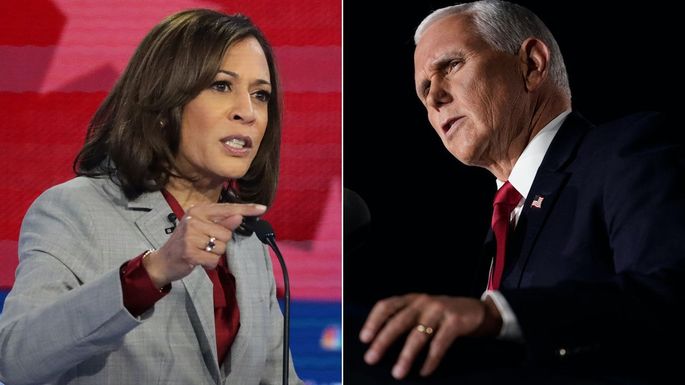

How do the vice presidential candidates stack up when it comes to housing?

The country is in the throes of a historic housing shortage that is pushing up prices to never-before-seen highs. Millions of renters are on the brink of evictions. And the housing affordability crisis is making it more difficult for many to achieve the American dream of homeownership.

So how do the vice presidential candidates stack up when it comes to housing?

“Their positions generally line up with their respective party lines,” says Realtor.com® Senior Economist George Ratiu. “[Pence] is very much more of a fiscally conservative proponent of property rights. [Harris] is a lot more focused on the affordability issues, which are particularly pressing in the current environment.”

What is Vice President Mike Pence’s housing track record?

Pence never released any grand housing plans during his tenure as governor of Indiana or when he served in Congress.

“It wasn’t a major issue [for him] in Congress or as governor,” says Michael Tanner, a senior fellow at the Cato Institute, a libertarian think tank based in Washington, DC.

But there are a few clues to be gleaned from his conservative views and years in office. Generally, the vice president has favored a smaller government footprint when it comes to the housing market.

- Pence has been a loyal supporter of Trump’s housing policies. Trump has capped mortgage deductions and property taxes, advocated for privatizing Fannie Mae and Freddie Mac, and did away with a rule that would have required many suburbs to become more racially diverse.

- As the 50th governor of Indiana, Pence signed a law in 2015 letting banks off the hook for the maintenance and upkeep of the foreclosed properties on their books. The law also made it easier for properties to be declared vacant to speed up their sales.

While serving in the U.S. House of Representatives, from 2001 to 2013, he also amassed a long track record of supporting and opposing various housing-related bills.

- As a congressman, Pence voted in 2010 against using Troubled Asset Relief Program money to provide legal services to those facing foreclosures during the Great Recession. The same year he opposed reauthorizing the National Flood Insurance Program, which uses tax dollars to subsidize flood insurance policies of homeowners living in flood-prone areas.

- He also voted against the Dodd-Frank Wall Street Reform and Consumer Protection Act introduced in the wake of the housing crash. The law basically did away with subprime mortgages and created stricter standards for who was eligible to receive the home loans. It also required lenders to better verify that someone’s financial information was accurate. The law also created the Consumer Financial Protection Bureau, which helps borrowers with mortgage issues.

- He was against allowing bankruptcy judges more power in restructuring the terms of mortgages on primary residences. He opposed a bill that standardized licensing requirements for mortgage lenders and required lenders to spell out the maximum costs that borrowers could be charged with on a loan, to prevent subprime and ballooning mortgages. He also voted against housing foreclosure assistance programs and expanding mortgage insurance programs.

- However, Pence was in favor of extending a home buyer tax credit for first-time buyers of 10% of the purchase price of a home up to $8,000. It also established a credit up to $3,250 for homeowners who have lived in their primary residence for five consecutive years. The amount was doubled for couples.