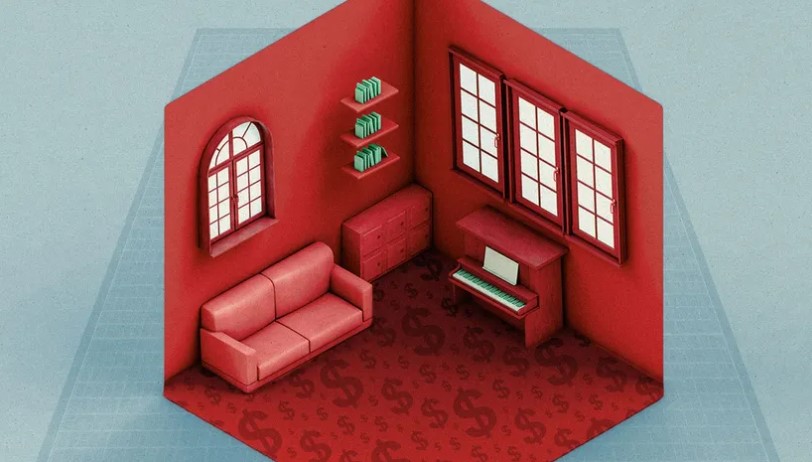

Why Many Home Buyers Now Need A $100,000-Plus Down Payment

Published by Forbes.com | June 25, 2024 While buyers were debating the need for a 20% down payment, it jumped to 35.4% for a median-income household A 20% down payment has long been the gold standard when buying a home, although there are some myths, pros, and cons regarding that specific percentage. But now, according …

Why Many Home Buyers Now Need A $100,000-Plus Down Payment Read More »