Published by Think Realty | March 28, 2025

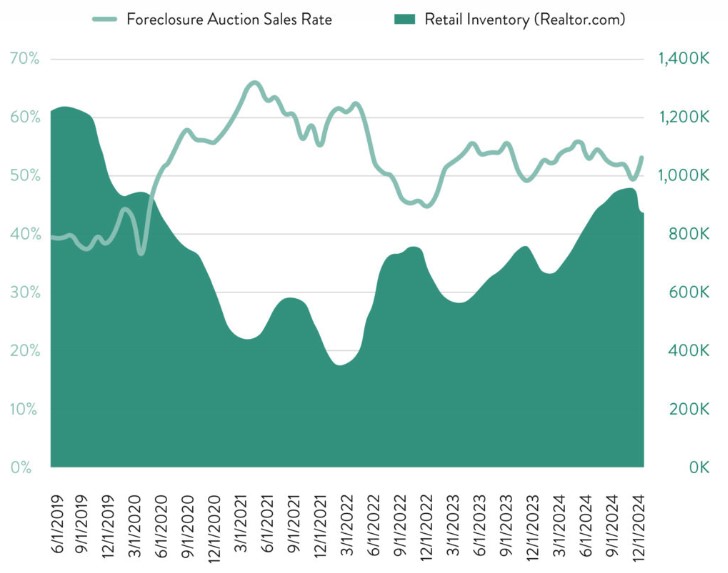

Bidding behavior at distressed property auctions acts as a reliable barometer of future retail housing market trends, and that bidding behavior in late 2024 points to a possible rebound in the spring and summer 2025 housing market.

As measured by sales rate—the share of properties available for auction that sell to third-party buyers—demand from the local community developers buying at foreclosure auction jumped in the final month of 2024, stopping a downward trend that started in June.

That sales rate was down or flat in five of the six months between June and November before spiking 7% in December to a five-month high. The December sales rate was also up 5% from a year ago.

Auction Prices Reflect Rising Confidence

Similarly, the price that winning bidders at auction were willing to pay relative to estimated after-repair value increased at the end of the year, up 3% in November and up another 3% in December. Those two monthly increases followed five out of six months with a declining bid-to-value ratio. The bid-to-value ratio in December was at a six-month high.

The bid-to-value ratio for properties purchased at bank-owned (REO) auctions also hit a six-month high in December, rising monthly in November and December following five out of six months with declines.

“The shortage of foreclosures going to auction is making us more likely to buy properties with tighter margins,” wrote one Auction.com buyer in response to a buyer sentiment survey sent in early January.

Election Results Bolster Investor Confidence

The survey found that the November election boosted the confidence of many local community developers buying at auction. More than one in four surveyed (43%) said the results of the election increased their willingness to buy distressed properties at auction compared to only 3% who said the results of the election decreased their willingness to buy. The remaining 54% said the election results had no impact on their willingness to buy.

“Election results should create a better market going forward,” wrote one survey respondent. Despite the market optimism surrounding the election outcome, most buyers still consider market conditions a headwind to their investing rather than a tail wind. More than one-third of buyers surveyed (35%) said the market environment is making them less willing to buy distressed properties at auction compared to 24% who said market conditions are making them more willing to buy.

“You know, it is a day-by-day market pulse,” wrote one buyer in the survey. “I feel better about the coming (months) but other world issues could change things.”

If the optimism among auction buyers—both in word and deed—that emerged in late 2024 continues into early 2025, it would bode well for the 2025 spring and summer housing markets.