Published by REALTOR.com | January 6, 2025

The U.S. housing market crawled to a standstill last year—and while the latest projections show that 2025 is expected to bring only limited relief to buyers and sellers, there is a glimmer of hope on the horizon.

The year closed out with the strongest seasonal slump since January 2023. Homes lingered on the market for a whopping 70 days, up from 62 in November. It made December 2024 the slowest festive season in five years.

Inventory also plummeted 8.6% from November, marking the most precipitous drop in nearly two years.

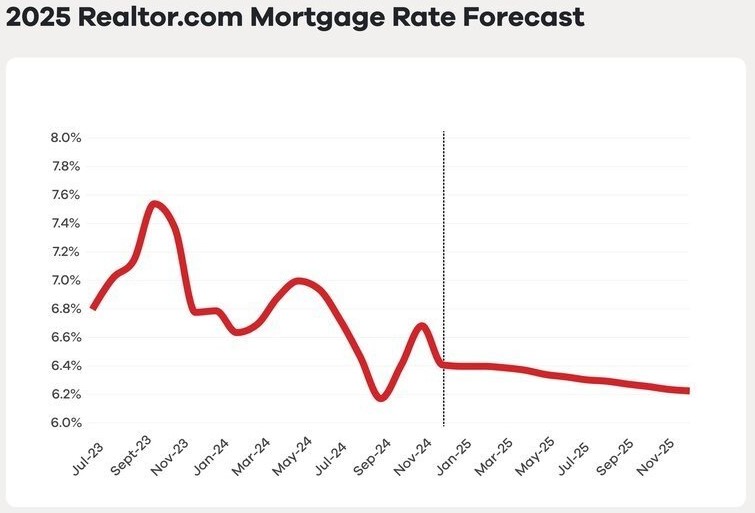

Meanwhile, mortgage rates reached a six-month high, hitting 6.91% for the average 30-year fixed home loan for the week ending Jan. 2, according to the latest numbers from Freddie Mac.

On top of that, in mid-December, the Federal Reserve announced a plan for fewer-than-anticipated rate cuts in 2025, which was expected to have a chilling effect on the already catatonic market.

The Realtor.com® economic research team projects that mortgage rates will average 6.3% through 2025 and end 2024 at around 6.2%, dashing any hopes for a return to the COVID-19 pandemic-era below-3% rate.

The ‘lock-in’ effect still grips homeowners

The projected above-6% mortgage rate for the duration of 2025 is bad news not only for prospective buyers, but also for would-be sellers, who have spent the past year in the grips of the “lock-in” effect, which has made them unwilling to list their properties and part with their current, significantly lower mortgage rates.

A report from the Consumer Financial Protection Bureau released back in September revealed that about 60% of the 50.8 million active mortgages had interest rates below 4%, way lower than the December rate of 6.91%.

Homeowners fortunate enough to be paying off their mortgage at the below-4% rate would think twice before moving to sell their home and then be forced to take out a new mortgage at a much higher rate.

“We expect the willingness of homeowners to sell their existing home and buy a new one to wane,” says Realtor.com Chief Economist Danielle Hale. “Put simply, potential home sellers and the market in general will still feel the effects of mortgage rate lock-in, which is more acute when rates are higher.”

But there are glimmers of hope on the horizon.

Hale says that while the first months of 2025 will see only a small increase in home stock, at least in part because of the lock-in effect’s persistent hold on homeowners, come spring, the inventory levels are projected to climb, even above the typical seasonal boost. She also projects that they will remain high throughout much of the summer.

“Time will continue to be an important healer of mortgage rate lock, with only modest help from lower rates expected in 2025,” Hale explains. “Even in today’s tough housing market, life happens and some households move, buying and selling in whatever conditions the market offers.”