Published by REALTOR.com | August 13, 2025

The state has drawn on a massive budget surplus to help pay for the cuts, but some experts warn that those surpluses won’t last, potentially setting the scene for a major deficit in the future.

Texas homeowners could be in line for one of the largest property tax cuts in state history, worth about $500 a year for the typical home, according to Texas Tribune’s calculations.

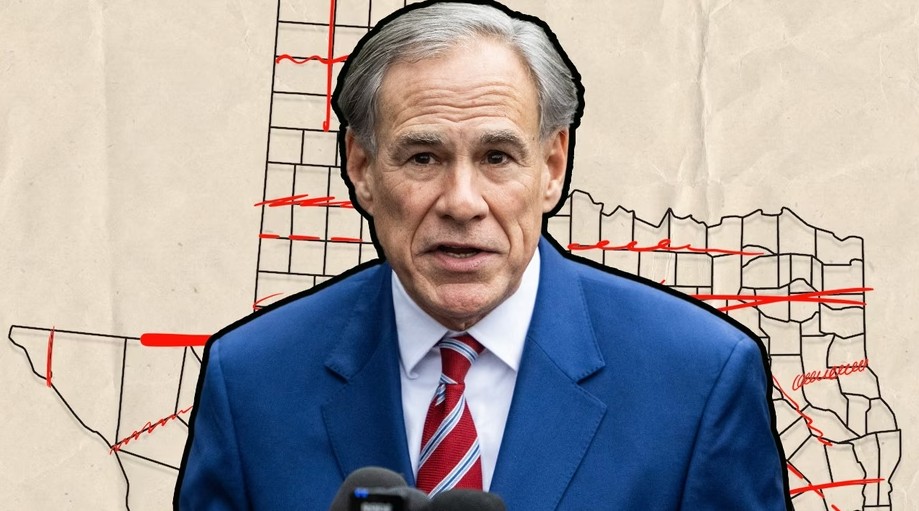

The relief, signed by Gov. Greg Abbott in June, would raise homestead exemptions, expand senior and disability breaks, and slash certain business property taxes.

But there’s a catch: It only happens if voters approve the measures this November. And instead of a statewide victory lap to sell the plan, the governor is locked in a bruising redistricting fight that’s stealing headlines, airtime, and attention from the historic tax cuts.

Here’s what Texas homeowners need to know about the upcoming ballot measures.

What the property tax relief would do

“Do you think your property taxes are too high?” Abbott asked a room full of voters and public officials in Denton, TX.

“Yes,” the room replied.

“So do I,” he responded to laughter from the crowd.

The joke was that they were all there to witness Abbott sign Senate Bill 4, Senate Bill 23, and House Bill 9, marking a historic property tax relief campaign for the state.

Together, the three bills could deliver major savings for homeowners and small business owners:

- SB 4: Raises the mandatory school district residence homestead exemption to $140,000, up from $100,000. When Abbott first took office in 2015, the exemption was just $15,000—making this a nearly 1,000% increase over his tenure.

- SB 23: Increases that exemption to $200,000 for seniors and disabled homeowners.

- HB 9: Raises the business personal property tax exemption from $2,500 to $125,000, easing the burden on small businesses across the state.

Abbott called the package “truly unprecedented,” noting that “no state in American history has devoted such a large percentage of their budget to tax relief.”

The cost would be monumental, accounting for 15% of the state’s total two-year spending plan, or $51 billion. A majority of those funds would go to school districts to account for the lost revenue from increased homestead exemptions. The state has drawn on a massive budget surplus to help pay for the cuts, but some experts warn that those surpluses won’t last, potentially setting the scene for a major deficit in the future.

Why it’s not a done deal

For all the fanfare, none of these tax cuts are guaranteed. Rather than pass cuts that only last for the current budget cycle, the state legislature took a more permanent approach, opting to enshrine this relief into the state’s constitution. But Texas law requires voter approval for changes to the constitution, which means the package won’t take effect unless it passes in the November 2025 election.

“We want to make sure we do more than just pass a law for this session that could be overturned by majority next session,” Abbott said at the signing ceremony. “We want to make sure that we pass laws that are enduring, that would require two-thirds votes, which mathematically would mean as it concerns increasing of tax, not in the lifetime of anybody in this room are you going to get two-thirds vote to increase a tax.”

Approval requires only a simple majority but abolishing a constitutional amendment requires a two-thirds majority of voters.

While the math is certainly in Abbott’s favor, off-year elections in Texas tend to draw far fewer voters than presidential or midterm years. In the last constitutional amendment election in 2023, turnout was just 14% statewide, according to the Texas Secretary of State’s office. That’s compared with 61% in 2024, and 66% in 2020, both of which were presidential election years.

That being said, Texans have historically backed property tax relief at the ballot box, passing a huge relief measure as recently as 2023.