Published by ZeroHedge on July 20, 2020

Delinquency rates across commercial properties have shot up faster than at any other time.

As thousands of restaurants, hotels, and local businesses in the U.S. struggle to stay open, delinquency rates across commercial mortgage-backed securities (CMBS) – fixed-income investments backed by a pool of commercial mortgages – have tripled in three months to 10.32%.

As Visual Capitalist’s Dorothy Neufeld notes, in just a few months, delinquency rates have already effectively reached their 2012 peaks. To put this in perspective, consider that it took well over two years for mortgage delinquency rates to reach the same historic levels in the aftermath of the housing crisis of 2009.

While there is optimism in some areas of the market, accommodation mortgages have witnessed delinquency rates soar over 24%.

Similarly, retail properties have been rattled. Almost one-fifth are in delinquencies. From January-June 2020, at least 15 major retailers have filed for bankruptcy and over $20 billion in CMBS loans have exposure to flailing chains such as JCPenney, Neiman Marcus, and Macy’s.

On the other hand, industrial property types have remained stable, hovering close to their January levels. This is likely attributable in part to the fact that the rise in e-commerce sales have helped support warehouse operations.

For multifamily and office buildings, Washington’s stimulus packages have helped renters to continue making payments thus far. Still, as the government considers ending stimulus packages in the near future, a lack of relief funding could spell trouble.

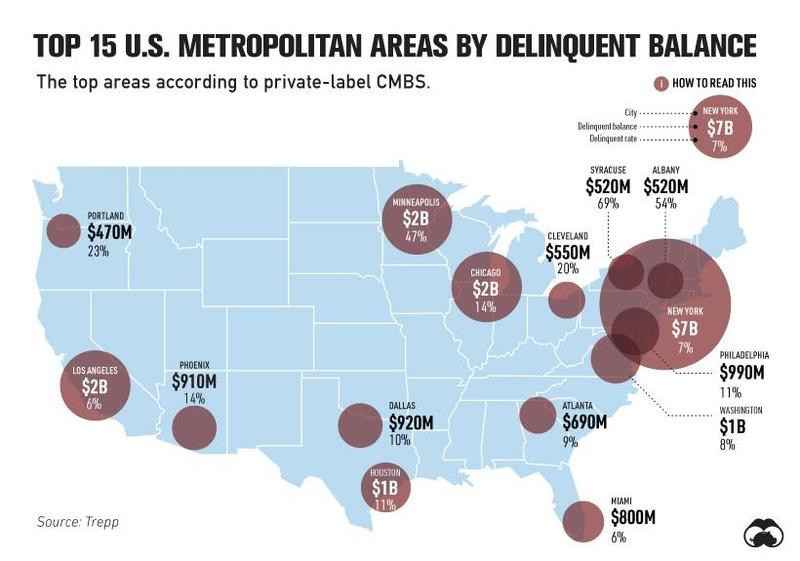

How do delinquency rates vary across the top metropolitan areas in America?