Delinquency rates climb on debt, pointing to downturn in $11 trillion market.

Defaults are rising in a key corner of the commercial real-estate debt market just as borrowing costs are set to jump, raising the likelihood of a slowdown of the $11 trillion U.S. commercial property sector in 2017.

A financial crisis-era regulation is about to take effect that is expected to make some commercial real-estate borrowing more expensive and complicated, analysts said.

At the same time, interest rates have increased since the election of Donald Trump as the nation’s 45th president last week and seem poised for a sustained rise from recent historic lows, which would further squeeze an industry built on borrowed money.

“I can paint a picture that it could be disastrous, with runaway inflation and high interest rates,” said Charlie Bendit, co-chief executive of Taconic Investment Partners LLC, at a New York industry luncheon last week.

The worries raise fresh concerns for the commercial property market as it enters its eighth year of expansion.

Already, landlords are battling a slowdown in sales and rising vacancy rates of multifamily housing units across the U.S. and of office space in Houston, Washington, D.C., and other big markets. Commercial property sales volume was down 8.6% in the first nine months of 2016 to $345.4 billion, according to Real Capital Analytics.

Now defaults are on the rise as well. More than 5.6% of some $390 billion worth of commercial property mortgages that have been packaged into securities was more than 60 days late in payment in September, according to Moody’s Investors Service. That was up from a 4.6% delinquency rate earlier this year.

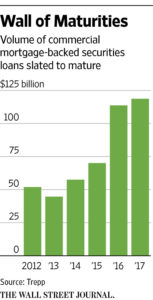

The culprit: loose lending before the financial crisis. Ten-year loans issued in 2006 and 2007 are now coming due, and many borrowers aren’t able to pay them off despite rising property values.

In all, Morningstar Credit Ratings LLC predicts borrowers won’t be able to pay off roughly 40% of the commercial mortgage-backed securities loans coming due next year. Suburban office properties and shopping centers are being hit particularly hard, said Edward Dittmer, a Morningstar vice president.

“We’re seeing a lot of stress,” Mr. Dittmer said.

Source: The Wall Street Journal http://www.wsj.com/articles/default-clouds-hang-over-commercial-property-sector-1479221223

Are these defaurlts you refer to in the national primary commercial markets held by NYSE real estate REITs?