The resumption of monthly debt repayments looming on the horizon for younger adults coincides with that point in their lives when they’re most likely to be shopping for homes.

Published by REALTOR.com | September 28, 2023

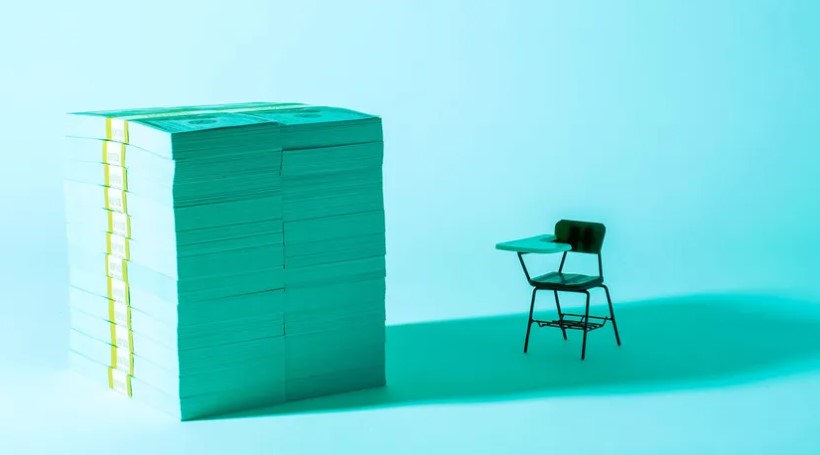

On Oct. 1, millions of Americans faced the harsh reality of having to resume student loan payments after a three-year respite instituted during the COVID-19 pandemic.

Of the roughly 43 million adult Americans with a federal student loan, the debt burden falls excessively on young adults, according to the New America think tank. Specifically, one-third of those who carry student loan debt are 25 to 34 years old, although Americans of all ages grapple with the debt.

The resumption of monthly debt repayments looming on the horizon for these younger adults coincides with that point in their lives when they’re most likely to be shopping for homes. However, paying off that debt plus mortgage rates stuck above 7% and home prices that continue to rise are likely to result in delays for many hoping to achieve the American dream of homeownership.

And it’s not just about owning a home.

“The age of first-time homeownership really does matter for long-term wealth building,” says Jung Hyun Choi, a senior research associate with the Housing Finance Policy Center at the Urban Institute. “We do find evidence that those who purchase homes younger in life have significantly greater housing wealth.”

Where do student loan repayments stand?

Millions of former students and graduates are expected to have had to rearrange their budgets to resume payments averaging $337 a month, according to The Motley Fool. Interest on the loans resumed on Sept. 1.

Those monthly payments are on top of pricier rents, inflation, the huge increase in mortgage rates over the past year, and higher home prices. That’s left many potential buyers facing the prospect of even higher monthly mortgage payments they can’t afford after some student loan relief efforts they were hoping for were stalled.

The U.S. Supreme Court blocked the one-time student loan forgiveness program from President Joe Biden‘s administration, which would have provided up to $20,000 in relief to millions of student loan borrowers. Before that decision, the administration had approved more than $116.6 billion in student loan forgiveness for more than 3.4 million borrowers.

In response to the Supreme Court’s ruling, the Biden administration launched the Saving on a Valuable Education (SAVE) Plan, which is an income-driven repayment plan that calculates student loan repayments based on a borrower’s income and family size—not their loan balance—and forgives the remaining balance after a certain number of years.

According to the administration, the SAVE plan “will cut many borrowers’ monthly payments to zero, will save other borrowers around $1,000 per year, will prevent balances from growing because of unpaid interest, and will get more borrowers closer to forgiveness faster.”

Some borrowers might still be eligible for student loan forgiveness via an existing student loan forgiveness program, including the Public Service Loan Forgiveness program.