Published by FOX Business | July 12, 2022

Higher mortgage rates, inflation contributing to cancellations

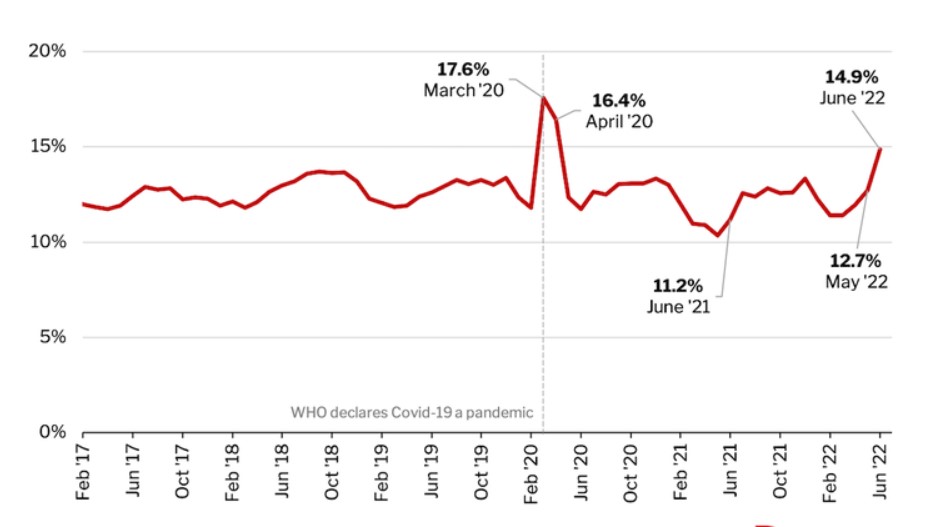

Approximately 600,000 home purchase agreements fell through in June, according to a new analysis by Redfin. The figure is equivalent to 14.9% of homes that went under contract during the month, an increase from 12.7% in May and 11.2% a year ago.

June’s percentage marks the highest cancellation rate since March and April 2020, when the housing market was rattled by the onset of the COVID-19 pandemic. Approximately 17.6% of homes under contract in March 2020 and 16.4% of homes under contract in April 2020 fell through.

Redfin deputy chief economist Taylor Marr attributes June’s increase to a slowdown in housing market competition, which has given homebuyers more room to negotiate.

“Buyers are increasingly keeping rather than waiving inspection and appraisal contingencies. That gives them the flexibility to call the deal off if issues arise during the homebuying process.”

–Taylor Marr, Redfin deputy chief economist

In addition, Marr said that some homebuyers are being priced out of their deals due to higher mortgage rates. Following a 75 basis point hike by the Federal Reserve in June, the average commitment rate on a 30-year fixed mortgage climbed toward 6%.