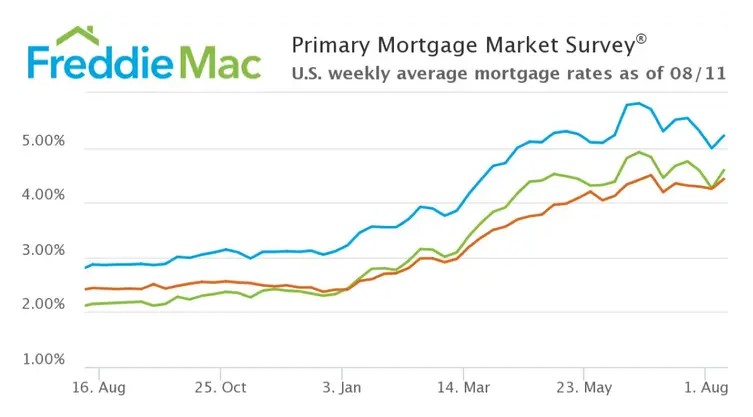

30-Year Mortgage Rates Increase to 6.92% — Highest Since 2002

Published by Breitbart News | October 13, 2022 The 30-year fixed mortgage rate rose to 6.92 percent on Thursday, the highest rate in over 20 years. According to data from Freddie Mac, after the 30-year-mortgage fixed mortgage rate declined by 0.04 percent from 6.7 percent on September 29 to 6.66 percent a week ago, it has since …

30-Year Mortgage Rates Increase to 6.92% — Highest Since 2002 Read More »