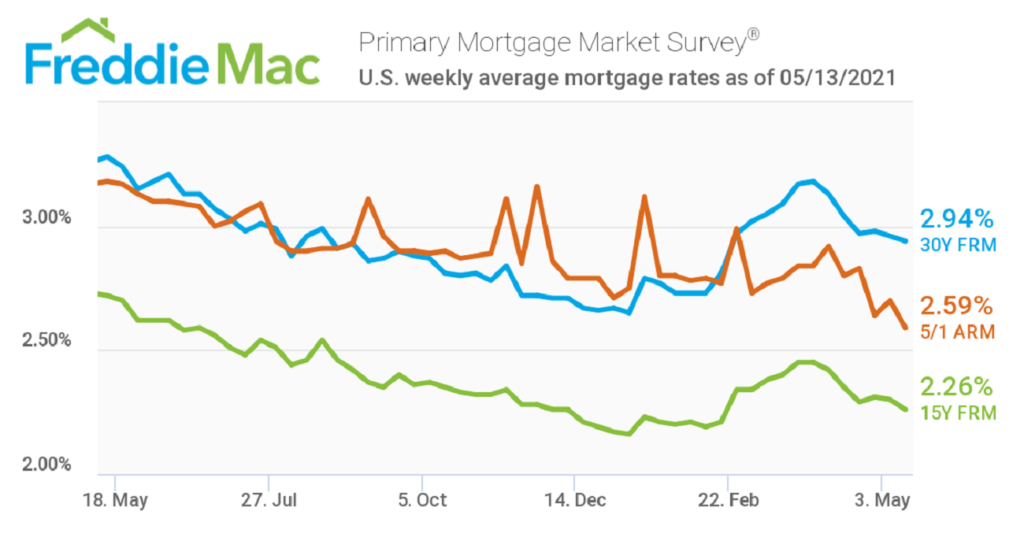

Mortgage Rates Are Surging Faster Than Expected, Prompting Economists to Lower Their Home Sales Forecasts

Published by CNBC | March 23, 2022 The 30-year fixed mortgage loosely follows the yield on the 10-year U.S. Treasury, which is now at the highest level since May 2019. The average rate on the popular 30-year fixed mortgage hit 4.72% on Tuesday, moving 26 basis points higher since just Friday, according to Mortgage News Daily. …