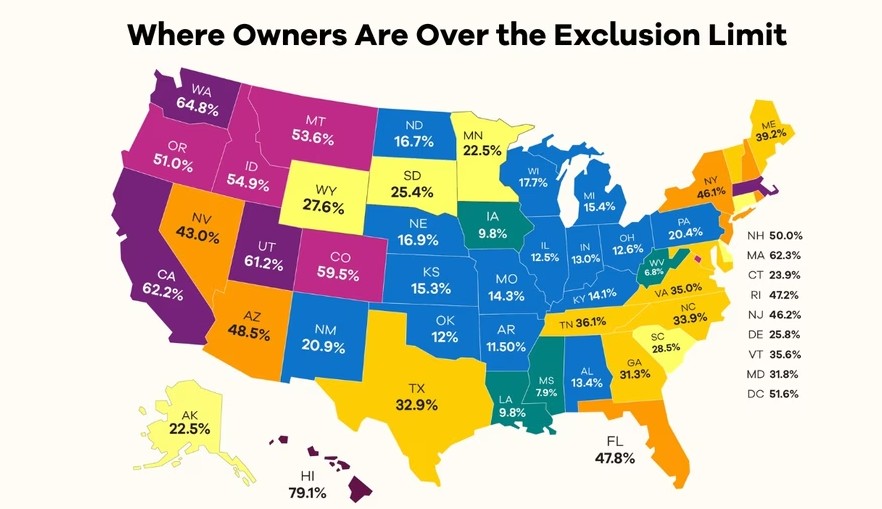

Co-Owning a Home? Claim the Wrong Tax Breaks and It Could Cost You Thousands

Published by REALTOR.com | August 15, 2025 As more and more people decide to enter co-ownership, the benefits need to be weighed against the drawbacks—for example, taxes. With home prices and interest rates still high, more people are buying property with friends, siblings, or parents to get a foot on the property ladder. It’s a …

Co-Owning a Home? Claim the Wrong Tax Breaks and It Could Cost You Thousands Read More »