Whether you invest in land, buy land notes and/or lend money against land, determining the value of the land is both difficult — and critical. This article by Seth Williams gives an overview of many of the principles involved in making that determination.

One of the biggest obstacles every land investor has to wrestle with is how to find the “market value” of vacant land.

It may seem like an odd dilemma to the typical real estate investor but trust me – if you’ve spent any amount of time trying to find comps or relevant valuation data for a parcel of raw land, you know that it can be incredibly challenging to nail down a concrete value for this type of real estate. It presents a major challenge to those who are new to the land business because most of the time, the data you need simply isn’t there.

Understanding How Appraisals Work

Before we get into the complexities of valuing land, let’s establish a fundamental understanding of how appraisals work.

In the vast majority of real estate transactions (especially when financing is involved), buyers and lenders will rely on an appraisal from an outside source to verify the value of the asset they are purchasing (aka – the collateral that their loan is secured by). The appraisal is a comprehensive report that usually considers three key valuation approaches. These approaches are known as:

- The Income Approach

- The Cost Approach

- The Sales Comparison Approach

These are widely considered to be the most reliable methods of determining a property’s market value. In most cases, an appraiser will use at least two (if not all three) of these methods to come up with their final conclusion. Here’s a quick overview of how each of them work

Income Approach

The idea behind this approach is to determine the amount of ongoing income (i.e. – rent revenue) a property can be expected to produce. In order to determine this number, an appraiser will look at the “market rent” in the area. In other words, what are similar properties currently renting for in the same market? The appraiser will look at a number of similar properties (while considering their size, location, condition, amenities, etc.) in order to get an idea for the amount of rent revenue the subject property could feasibly produce. This approach is looking at the property purely from a revenue generation standpoint.

Cost Approach

With this approach, the appraiser is trying to nail down the cost to rebuild the exact same structure from the ground up. The appraiser will take the estimated cost of construction, based on today’s prices (minus depreciation, plus land) and use this to come up with one perspective of the property’s market value.

There are a lot of big assumptions that live inside of this particular approach (e.g. – the cost of building materials, the assumption that nobody will ever pay more than the cost to build, etc). The cost approach is an important consideration – but it’s almost never enough to use this approach all by itself to determine a property’s market value.

Sales Comparison Approach

With this valuation method, the appraiser will look at the recent sales of similar properties in the area. With this approach, the appraiser is making the general assumption that a typical buyer will not pay more for the subject property than they would have paid for a similar property in the same area. Appraisers will only consider the data from properties that have actually been sold, because these are concrete numbers and (in theory) they represent real purchase prices that have actually been paid. Appraisers usually find this data from various public records, real estate agents, other appraisers, etc.

The Problem With Land

These valuation approaches usually work great for conventional real estate projects (houses, apartments, commercial buildings, etc.) but I’ve found that in most cases, these approaches simply aren’t feasible methods when it comes to assigning a market value to most vacant land properties because at least 90% of the time, the data needed to draw these conclusions simply isn’t available.

It’s a frustrating dilemma for land investors, because it is extremely important for us to understand a property’s market value. It’s a piece of the puzzle that drives everything else in the process (our offer price, the cost of property taxes, holding costs, closing costs, etc.). If we can’t be certain about a property’s market value, we’ll have to live with some major risk and ambiguity (and this is never ideal, especially when you’re investing a fortune into a property that you can’t afford to be wrong about).

How To Deal With Ambiguity

Unfortunately, there is no “magic bullet” when it comes to valuing land. As any real estate appraiser can tell you, it’s virtually impossible to reach the point of 100% certainty (down to the penny) about the market value of a property.

Unfortunately, there is no “magic bullet” when it comes to valuing land. As any real estate appraiser can tell you, it’s virtually impossible to reach the point of 100% certainty (down to the penny) about the market value of a property.

That being said – there is almost always a way to get reasonably comfortable with a “ballpark value” on a property… even one as tricky as vacant land. It’s not a black and white valuation approach by any stretch, but there are a number of reliable measurements you can use to get confident with the value of a prospective property.

When I’m seriously evaluating a potential land investment, I start by looking at several different factors and asking myself, “How important will these factors be to my end buyer?”

What is the zoning on this property?

- What can this land be used for? Can someone use it to build a house? Office Building? Factory? Farming? Hunting? Mining? Make sure you understand what your (or the future owner) will be allowed to do with the property in accordance with the local zoning and planning requirements.

How much inventory is available in the local market?

- Is this a one-of-a-kind property or are there hundreds of others exactly like it on the market right now?

What are other, similar properties currently priced for in the near vicinity?

- If you were the owner of this property, and you listed it for sale today, what kind of competition would you have to deal with? If you can acquire it for the price you want, will you be able to re-list it, and price it exceedingly better than all the other properties in the area?

How desirable is this property?

- Think of this as the “common sense” approach… what was your first impression when you saw this property? Did anything about it look interesting, desirable, appealing or attractive? Be honest – is there anything sexy about it? Will it catch anyone’s interest? Are you looking at a gorgeous, wooded, mountainside lot – or is it a dry, barren, hostile wasteland? If you go through the effort of creating a great property listing, how beautiful will you be able to make this property look? Can you give buyers an offer they can’t refuse?

What kinds of holdings costs are associated with this property?

- Suppose you buy this property and you can’t sell it immediately. What if you have to hang onto it for 6 months? 12 months? 2 years? If you’re forced to hold onto this property for longer than you want to, how much will it cost you (e.g. – property taxes, associates fees, assessments, etc.)? Can you afford it? Is it worth the risk?

Does the property have road access? How easily can someone get to it?

- You’ll always want to verify that the property has road access or some kind of legal easement so that people can actually get to it. If it doesn’t have any access (and believe me, there are a surprising number of vacant lots that don’t), your property might as well be on the moon. Make sure the property has legal access – or walk away.

What is the size, shape & dimensions of the property?

- Think about what this property might be used for some day. Is the parcel big enough? Does it have an odd shape? Is it located next to anything that would significantly decrease its desirability? Be sure to note any red flags that you run into… these can be serious issues that will influence the property’s value.

How close is this property to the local conveniences and amenities?

- Consider what kinds of amenities or local attractions will be available to the owner of this property. Will they have a grocery store across the street, or will they have to drive 3 hours to get there? Will you be able to market the property’s location as a good thing?

What do the adjoining properties look like?

- The properties next door can have some MAJOR implications for the value and “sale-ability” of a parcel of land, e.g. – Would you prefer to live next to Glacier National Park or a Meth Lab? (For info on Glacier National Park, click HERE).

Most people care a great deal about who their neighbors are, so get a good idea for how the surrounding properties could impact the desirability of your property. If the adjoining properties have any obvious issues that are beyond your control, you’ll want to think carefully about what this means for the property’s value.

Is the property situated in a flood zone?

- When properties are located within a flood zone, the cost of flood insurance has to potential to bevery expensive, and this added cost of property ownership can have a major impact on the feasibility of building a home on the property (and since many people buy land with the intent of building something on it, this is a very relevant detail). To get an idea for whether a property is situated within a flood zone, check out the FEMA website or FreeFlood.com and do a property search to see if your property is situated within or nearby a flood zone.

Valuation Hacks For The Savvy Investor

Even though the data for valuing vacant land is sparse in most areas, there are still some alternative approaches that can help you zero in on a realistic value of the property you’re evaluating. Here are a couple of tricks I use on a regular basis…

Scour the MLS for Similar Listed Properties

This approach is far from perfect (for obvious reasons), but it does do one thing quite well… it will inform you of what kind of competition you’re dealing with (and what those sellers expect to get out of their property). In other words – if you were to list your subject property for sale today, what other “deals” would you have to stand out against?

Take a minute and do the math. Once you understand what price your property will have to be listed forin order to look like the best deal on the market, this will give you a better perspective for the property’s potential value in contrast to the current market (because if you’re offering the best deal, it will theoretically be the first one to sell).

Note: Another clever way to go through this exercise with a similar site called Redfin (as I explain in much greater detail in this blog post). The primary difference is that Redfin allows you to download a CSV file and get MUCH more creative with the data analysis (for all the nerds out there). The net result is that you’ll be able to make more of a data-driven decision, rather than simply “going with your gut” after seeing a few vaguely similar listings in the area. It’s worth a try!

Call 2 or 3 Local Real Estate Agents and Ask Their Opinion:

This isn’t a foolproof method, but it does help to “tell the story” of what your subject property may be likely to sell for. When I call local real estate agents, I’ve found it can be helpful to say something like this:

“Suppose I owned this property free and clear and I wanted to list it for sale with you today. What price would I have to list it for if we wanted this thing SOLD within the next 6 months?”

This kind of statement tells the agent a couple of things:

- You’re looking for a realistic idea of what it will take to sell this property quickly. You’re serious about getting this thing sold, and you want some honest answers.

- If this agent helps you – you may actually be willing to hire them for the job! This will encourage them to give you the time of day and offer up some legitimate answers.

As you’re having these conversations, pay close attention to the prices they suggest. If they throw out some numbers that clearly aren’t going to work for you, now is the time to figure that out (instead of after you’ve already bought the thing).

Another thing to keep in mind is that you might actually want to hire one of these people to list this property in the future. It doesn’t hurt to start reaching out and making connections with agents on the front end like this… their services might actually come in handy.

My primary warning would be this: Don’t put too much faith in any ONE agent’s opinion. There are a lot of clueless real estate agents out there (especially when it comes to vacant land), so if you’re going to go through this exercise, make sure you’re getting input from at least 2 or 3 people (the more the merrier).

Finding Comps (When Comps Are Available)

Depending on what market you’re working in – it may be possible to find some recent, relevant comps on your property

FindCompsNow.com is pretty effective when your goal is to work with single family homes and the like (which tend to have a MUCH larger pool of comps to work with). I think you’ll find some extra challenges when working with land, but I still think this is a decent place to start if you’re just beginning the process of valuing your subject property.

An Appraiser’s Perspective

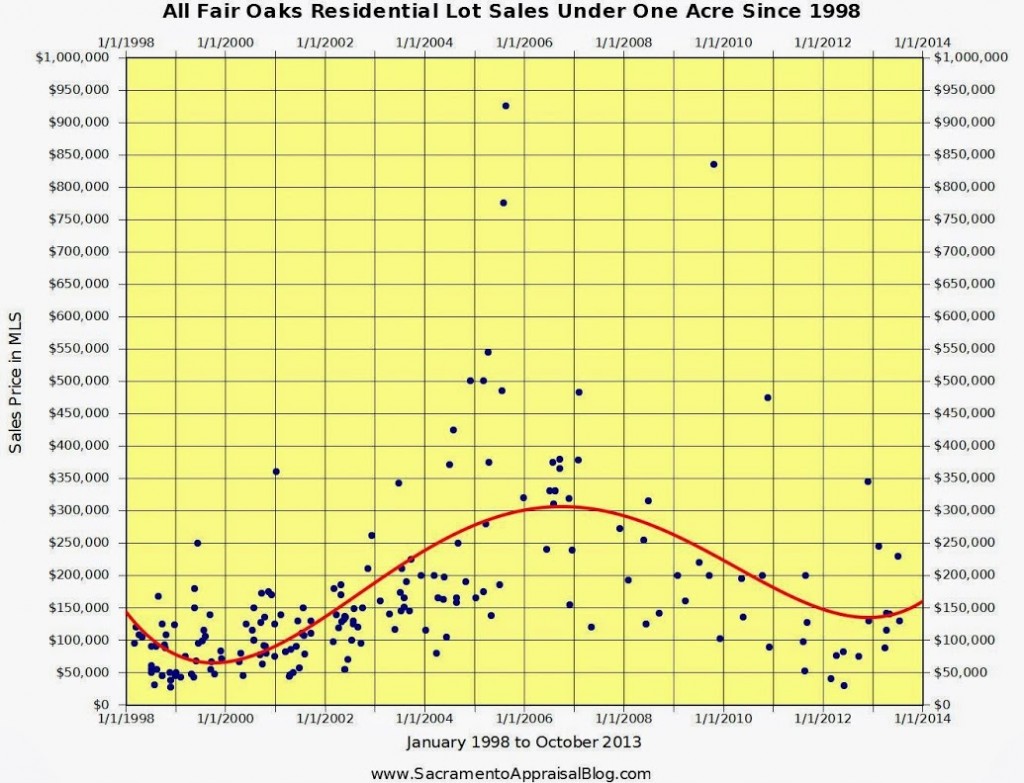

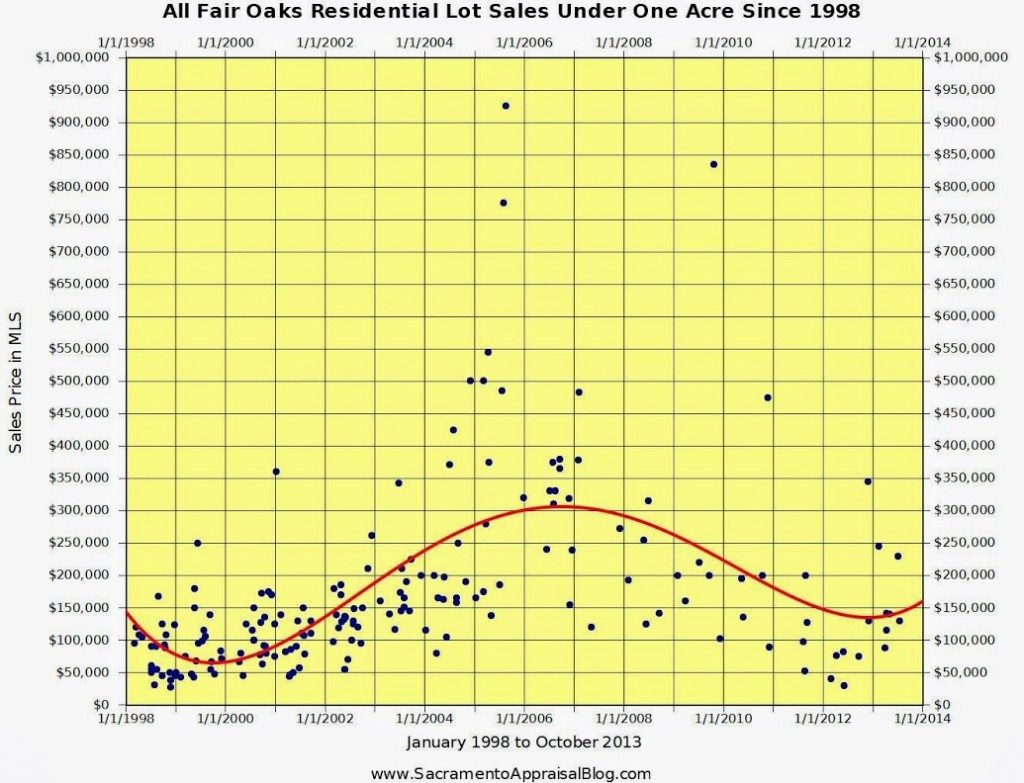

Rather than limiting this post to an investor’s (aka – MY) perspective on how to value land – I wanted to dig a bit deeper and understand land valuations from an appraiser’s perspective. I reached out to Ryan Lundquist (owner of Sacramento Appraisal Blog and a certified appraiser in the State of California) to get his input on how he would approach the task of valuing land.

Rather than limiting this post to an investor’s (aka – MY) perspective on how to value land – I wanted to dig a bit deeper and understand land valuations from an appraiser’s perspective. I reached out to Ryan Lundquist (owner of Sacramento Appraisal Blog and a certified appraiser in the State of California) to get his input on how he would approach the task of valuing land.

When it comes to real estate valuations, this guy’s word carries a lot more weight than mine because he is working in this world every day. As an appraiser, he understands how one would approach this process using the conventional standards that are well-established in the real estate industry.

Ryan’s input both solidified and challenged some of my previous assumptions about the concept of land valuation. Here is our brief interview:

What are the first and most important factors you would look at to determine the ballpark value of a vacant land property?

It’s honestly not easy to determine a ballpark value for a piece of land because there are so many factors to consider (as we’ll get to below). Plus, since I hold a state license to appraise property, I have to actually support the values I give – whether I’m giving a verbal “ballpark” value or a full, written appraisal. I am essentially liable for any value I give, so that is why it can be challenging when people call me and say, “I don’t need a full appraisal, but just a quick value.” I get what people are asking, but since I actually have to support the value I give, it is more involved on my end.

Let’s talk about location, zoning and topography. Why are these things important? What is it about these three factors that would cause a property’s value to go UP or DOWN?

Everyone knows real estate is about location. A site next to a toxic dump, for example, probably isn’t going to fetch high dollars, but a vacant lot in an upscale neighborhood is going to be worth much more.

(That being said) Not all vacant lots are created equal and this is where zoning comes in to play. Zoning helps tell us what the site can be used for legally. This means if a vacant lot was zoned for residential housing and it could be split into four buildable lots, that might carry much more weight than a lot that isn’t buildable at all (for whatever reason). On the other hand, if zoning would only permit a property for industrial use, it’s worth considering whether that use can be fully realized in the current market. In other words, is it a good market to improve an industrial lot?

Lastly, topography is crucial. Two separate lots might have the same exact size on paper, but if one of them is on a steep incline and has very little buildable space, the lot that is actually useable could be worth much more.

In your opinion, is land a difficult type of real estate to value? If so, why?

It sometimes feels difficult because there are definitely fewer comps. Sparse data always makes for more challenging valuations. Since the bulk of my work involves lots that have already been improved, that is definitely part of why it takes me longer.

(Note: When the data is available, this is the kind of visual context that Ryan likes to provide for his clients)

?

When an appraiser nails down the value of a vacant parcel of land, how much deviation (or “lack of reliability”) do you think there is on this number and why?

It honestly depends on the appraiser and how good the report is. There is no real “standard” end-all answer to this question. The reader of an appraisal report will have to sniff out whether it seems legitimate or not. Does the report tell a compelling story of value so that the value makes reasonable sense?

How much weight and importance would you give to the following factors?

-

The property’s assessed value

I suppose it really depends on how good the assessment is. Some areas may be better than others. However, one important consideration is that assessments in my area at least are based on when the property was purchased instead of current market value. This means an assessment for a piece of land purchased 15 years ago might show a profoundly lower value than what the current market is willing to pay. Personally I pay almost no attention to the assessment for this reason.

-

The listed prices of similar lots in the area

I think the list price for similar properties can say something about value, though sometimes listings are out-of-sync with the market. I do pay attention to them (as well as pending and withdrawn transactions), but it’s always important to judge each one on its own – and determine whether it says something about the market or not. I do want to know how much interest similar properties have had from buyers when exposed to the open market and [it also helps to know] how many days they spent on the market too. It can be telling if listings aren’t selling at a certain level or if they’re fetching a lot of interest at a certain price.

-

The amount of inventory (of similar properties) on the market

This is important because when there is more inventory in a market, it tends to water down the price (due to the increased competition). This is basic economics. When there is more supply than demand, prices will inevitably come down.

For the typical land investor who is trying to nail down a “ballpark value” of a vacant lot (WITHOUT ordering an appraisal), are there any common valuation mistakes or dangerous misconceptions they should watch out for?

I would say to make sure you are comparing apples to apples. One lot might look very competitive on paper, but when driving by or at least viewing it on Google “Street View”, differences can become apparent. I would also recommend talking with the city to ensure the land use and zoning are understood. I say this becausesometimes information provided in Tax Records may not be accurate. The definitive word should come from the planning department instead of published records that may not have been updated in years.

It’s An Art, Not A Science.

Believe me, I would LOVE to give you a crystal clear approach to valuing land that will always work,every time – but I’m afraid there is no such thing (and if anyone tries to tell you otherwise, I’d be highly suspicious of whatever they’re trying to sell you). The fact is – even an appraiser’s opinion should be taken with a grain of salt. When we’re talking about real estate (…or any other product or service, for that matter), the final rule is this:

It’s worth whatever someone is willing to pay for it.

The data (when available) can give us a really good idea on this, but even that isn’t a certainty. At the end of the day, the value is more contingent on finding the right buyer, for the right property, at the right time. Extracting the most value from any piece of real estate is an art, not a science.

When it comes to determining the value of land – the best you can do is perform a reasonable amount of research. Take the time you need to carefully consider the items listed above. Dig up whatever data you can find with tools like AgentPro247, look at other locally listed properties on Zillow and use the best, most unbiased judgment you can manage.

At the end of the day, if you’re making offers that are low enough to protect yourself from the inescapable risks of land investing (due to the difficulty of getting perfect valuations), you should be giving yourself a healthy buffer that will help to offset any errors in judgment that you might be making along the way. This is the way I’ve been doing it for years, and while I can’t say I’ve always done it perfect,I can say that I’ve never been burned to the point that I couldn’t bounce back.

This article was written by Seth Williams. Visit his website: http://retipster.com/valueofland/