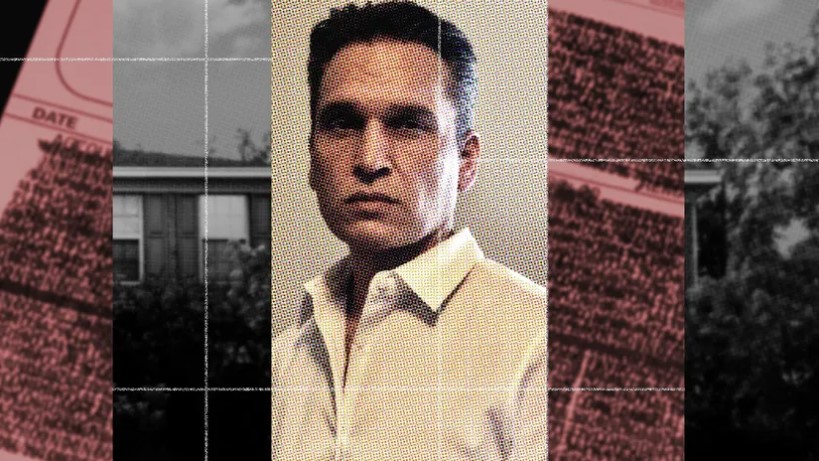

Mortgage Fraudster Who Served 13 Years in $55M Scheme Now Helps Fight Scammers

Published by REALTOR.com | May 4, 2024 Since his guilty plea, Cox says he’s reformed and has turned his unusual talents to fighting fraud. In the late ’90s, Matthew Cox was 29 and starting a new job as a mortgage broker in Tampa, FL, when he committed his first act of mortgage fraud by erasing a borrower’s late payment …

Mortgage Fraudster Who Served 13 Years in $55M Scheme Now Helps Fight Scammers Read More »